All Categories

Featured

Table of Contents

- – Dependable Accredited Investor Crowdfunding Op...

- – Top-Rated Accredited Investor Wealth-building ...

- – Personalized Accredited Investor Wealth-build...

- – Five-Star Accredited Investor Opportunities

- – Top Investment Platforms For Accredited Inve...

- – World-Class Accredited Investor Passive Inco...

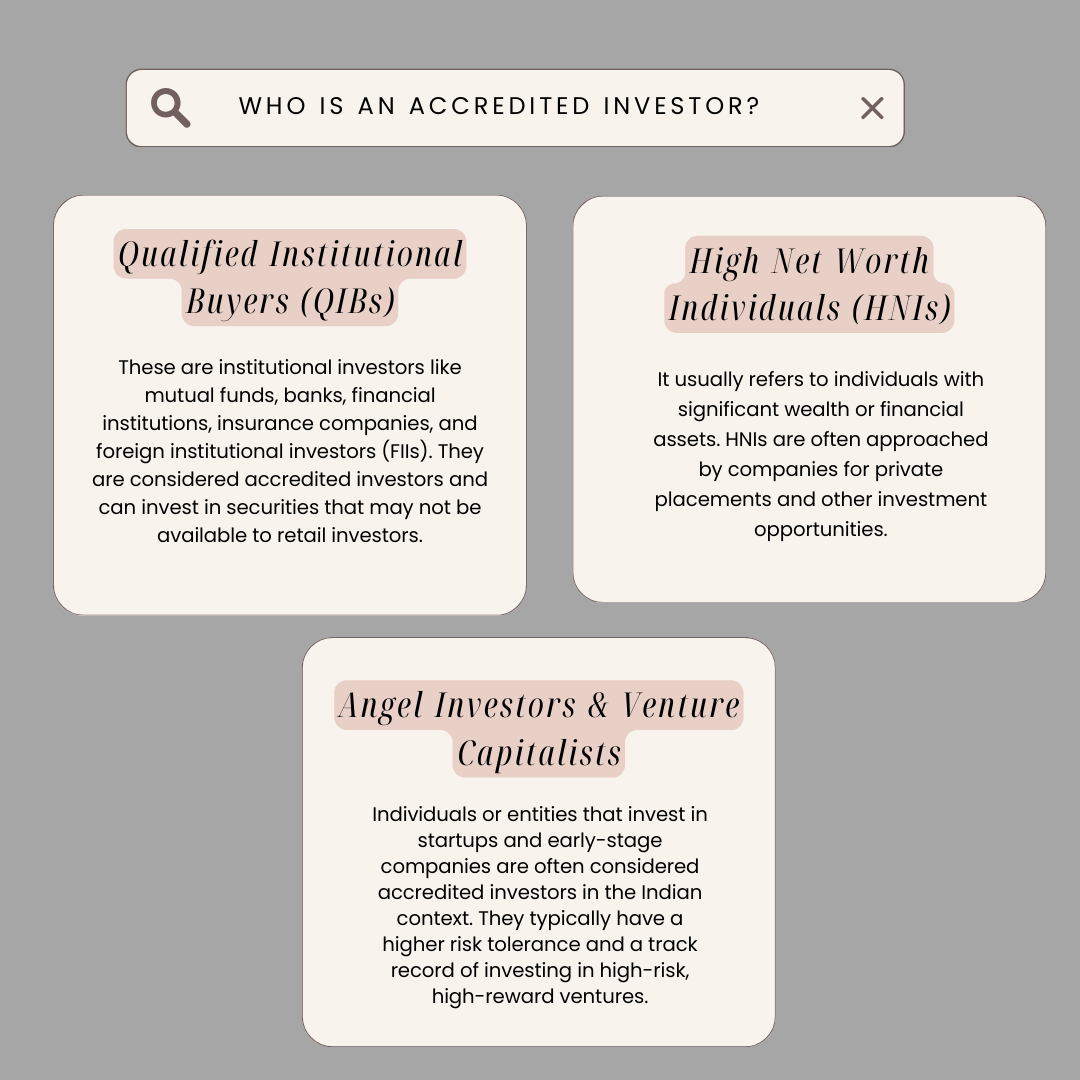

These financiers are presumed to have the monetary elegance and experience required to examine and spend in high-risk financial investment possibilities inaccessible to non-accredited retail financiers. In April 2023, Congressman Mike Flood presented H.R.

Dependable Accredited Investor Crowdfunding Opportunities

For now, currently must abide by the term's existing definition. There is no official process or federal certification to become a certified capitalist, an individual may self-certify as a certified investor under existing guidelines if they gained more than $200,000 (or $300,000 with a spouse) in each of the previous two years and expect the exact same for the existing year.

People with an energetic Series 7, 65, or 82 license are also taken into consideration to be certified investors. Entities such as corporations, partnerships, and trust funds can also accomplish recognized capitalist standing if their investments are valued at over $5 million. As recognized capitalists, people or entities might participate in personal financial investments that are not registered with the SEC.

Top-Rated Accredited Investor Wealth-building Opportunities

Right here are a couple of to think about. Private Equity (PE) funds have revealed remarkable development in the last few years, relatively undeterred by macroeconomic obstacles. In the 3rd quarter of 2023, PE offer quantity exceeded $100 billion, about on par with deal activity in Q3 of the previous. PE firms swimming pool capital from accredited and institutional capitalists to obtain managing interests in fully grown personal companies.

In addition to capital, angel financiers bring their specialist networks, assistance, and experience to the start-ups they back, with the expectation of venture capital-like returns if the service takes off. According to the Center for Venture Research study, the ordinary angel investment amount in 2022 was approximately $350,000, with financiers receiving an average equity stake of over 9%.

That claimed, the development of on the internet personal credit report platforms and specific niche sponsors has made the possession course accessible to specific recognized financiers. Today, capitalists with just $500 to invest can take advantage of asset-based exclusive debt opportunities, which use IRRs of approximately 12%. In spite of the surge of shopping, physical supermarket still make up over 80% of grocery store sales in the United States, making themand particularly the realty they run out oflucrative investments for certified capitalists.

Personalized Accredited Investor Wealth-building Opportunities

In contrast, unanchored strip facilities and neighborhood facilities, the following 2 most greatly negotiated kinds of property, taped $2.6 billion and $1.7 billion in transactions, respectively, over the same duration. But what are grocery store-anchored facilities? Country shopping center, outlet shopping centers, and various other retail centers that include a significant food store as the area's major lessee typically drop under this category, although malls with enclosed pathways do not.

To a lesser level, this phenomenon is likewise true in opposite. This uniquely symbiotic relationship in between a facility's lessees increases demand and maintains leas elevated. Recognized investors can purchase these spaces by partnering with property exclusive equity (REPE) funds. Minimum financial investments usually start at $50,000, while overall (levered) returns vary from 12% to 18%.

The market for art is likewise increasing. By the end of the decade, this figure is expected to come close to $100 billion.

Five-Star Accredited Investor Opportunities

Capitalists can now possess diversified private art funds or purchase art on a fractional basis. These alternatives come with investment minimums of $10,000 and provide net annualized returns of over 12%.

(SEC).

The demands of that can and who can not be a certified investorand can take part in these opportunitiesare determined by the SEC. There is a typical false impression that a "procedure" exists for a specific to come to be a recognized financier.

Top Investment Platforms For Accredited Investors

The problem of confirming an individual is a recognized financier drops on the financial investment automobile instead than the investor. Pros of being an approved capitalist include access to special and limited financial investments, high returns, and enhanced diversity. Cons of being an accredited investor include high danger, high minimum financial investment quantities, high charges, and illiquidity of the financial investments.

D) offers the interpretation for a certified capitalist. Merely placed, the SEC defines an accredited investor via the confines of income and web worth in 2 ways: An all-natural person with revenue going beyond $200,000 in each of the 2 most recent years or joint earnings with a partner exceeding $300,000 for those years and an affordable assumption of the very same revenue degree in the current year.

Approximately 14.8% of American Families certified as Accredited Investors, and those families regulated roughly $109.5 trillion in wide range in 2023. Determined by the SCF, that was around 78.7% of all private riches in America. Policy 501 additionally has stipulations for firms, partnerships, philanthropic organizations, and counts on in enhancement to firm directors, equity owners, and financial organizations.

World-Class Accredited Investor Passive Income Programs for Accredited Investor Opportunities

The SEC can include certifications and designations going ahead to be consisted of along with urging the public to submit proposals for various other certificates, classifications, or qualifications to be taken into consideration. exclusive deals for accredited investors. Employees who are thought about "well-informed staff members" of an exclusive fund are now likewise thought about to be recognized capitalists in concerns to that fund

Individuals who base their qualifications on yearly earnings will likely need to submit income tax return, W-2 forms, and various other records that suggest earnings. People might additionally take into consideration letters from testimonials by Certified public accountants, tax obligation lawyers, investment brokers, or advisors. Approved capitalist classifications likewise exist in other nations and have comparable requirements.

In the EU and Norway, for instance, there are three examinations to determine if an individual is a certified financier. The initial is a qualitative examination, an assessment of the individual's proficiency, knowledge, and experience to determine that they are qualified of making their very own investment decisions. The 2nd is a quantitative examination where the person needs to meet two of the adhering to standards: Has lugged out transactions of significant dimension on the pertinent market at an average frequency of 10 per quarter over the previous 4 quartersHas a monetary profile surpassing EUR 500,000 Functions or has functioned in the financial sector for at the very least one year Finally, the customer needs to state in written type that they wish to be treated as an expert customer and the firm they wish to work with must notify of the protections they can shed.

Table of Contents

- – Dependable Accredited Investor Crowdfunding Op...

- – Top-Rated Accredited Investor Wealth-building ...

- – Personalized Accredited Investor Wealth-build...

- – Five-Star Accredited Investor Opportunities

- – Top Investment Platforms For Accredited Inve...

- – World-Class Accredited Investor Passive Inco...

Latest Posts

Real Estate Tax Lien Investments For Tax Advantaged Returns

How To Invest In Tax Lien

What Is Tax Lien Investing

More

Latest Posts

Real Estate Tax Lien Investments For Tax Advantaged Returns

How To Invest In Tax Lien

What Is Tax Lien Investing