All Categories

Featured

Table of Contents

The is a Module from Rather than the complete 8-week program, overages and get additional documents concerning surplus overages. This course is created for both new and seasoned, Property Entrepreneurs that intend to learn how to create a successful realty company by leveraging the covert diamonds readily available across the USA via Tax Obligation Liens & Tax Obligation Action Public Auctions.

This course includes a detailed process of just how to come to be a Surplus Overages Recovery Representative (tax lien sale). The training course consists of supporting files, checklists, resources and state regulations to aid navigate to the states that are capitalist friendly. The Tax Obligation Deed Wizard Surplus Healing Agent course is promptly readily available upon successful enrollment

Students will certainly be able to access the course once they are efficiently enlisted. For added convenience, signed up students can access the course lessons 24/7 whenever it's hassle-free for them. Sustaining documents, resources, and devices can be downloaded and install. The Tax Obligation Deed Surplus Excess Healing program contains 15 lessons. Most pupils finish the course in 1-2 weeks depending upon their timeframe.

The is a Module from the Rather than the full 8-week program, excess and receive additional papers regarding excess excess. This training course is developed for both brand-new and experienced, Real Estate Entrepreneurs that wish to find out how to produce a successful property company by leveraging the covert diamonds readily available throughout the USA through Tax Liens & Tax Action Public Auctions.

This training course is for brand-new or experienced investor that what to learn the ins and outs of being a Surplus Healing Representative. Tax Deed Surplus Recuperation Professionals assist previous building owners who lost their residential properties in a Tax obligation Deed Sale, send cases to collect monies owed to them from the region.

Unpaid Taxes On Houses

The program includes supporting papers, checklists, resources and state legislations to aid navigate to the states that are investor pleasant. The Tax Obligation Deed Wizard Surplus Healing Representative training course is instantly offered upon effective registration. Students can review each lesson at their ease 24/7 in our Learning Management System. Pupils will certainly have the ability to access the course once they are successfully enrolled.

Sustaining papers, resources, and tools can be downloaded. The Tax Deed Surplus Excess Healing training course consists of 15 lessons. Many pupils complete the course in 1-2 weeks relying on their duration. At the end of the lessons, an end of module quiz is obligatory with a passing quality of 90%.

Tax sale overages happen when a tax-foreclosed home is offered at auction for a greater rate than the owed taxes., additionally called overages, are the distinction between the sale price and the tax obligations due.

This company includes aiding individuals on filing claims. There are tax obligation deed excess, mortgage foreclosures that cause surplus funds and also unclaimed state funds.

Every so often, I hear discuss a "secret brand-new possibility" in the service of (a.k.a, "excess profits," "overbids," "tax obligation sale surpluses," and so on). If you're entirely not familiar with this concept, I would love to offer you a fast introduction of what's taking place here. When a homeowner stops paying their real estate tax, the regional municipality (i.e., the area) will wait on a time prior to they confiscate the home in foreclosure and sell it at their yearly tax obligation sale public auction.

The info in this short article can be impacted by numerous special variables. Intend you possess a property worth $100,000.

Foreclosure Overages List

At the time of foreclosure, you owe regarding to the area. A couple of months later, the county brings this residential or commercial property to their yearly tax sale. Here, they market your residential property (along with loads of other delinquent residential or commercial properties) to the highest possible bidderall to recoup their shed tax obligation earnings on each parcel.

Many of the investors bidding on your property are completely mindful of this, as well. In lots of cases, residential properties like yours will obtain proposals Much past the amount of back tax obligations really owed.

Surplus Tax Refund Check Status

Obtain this: the area just needed $18,000 out of this residential or commercial property. The margin in between the $18,000 they required and the $40,000 they obtained is known as "excess proceeds" (i.e., "tax sales overage," "overbid," "surplus," etc). Many states have laws that restrict the region from keeping the excess payment for these residential properties.

The area has rules in location where these excess earnings can be claimed by their rightful owner, generally for a designated duration (which varies from one state to another). And who exactly is the "rightful owner" of this money? Most of the times, it's YOU. That's ideal! If you lost your residential property to tax foreclosure because you owed taxesand if that residential property consequently marketed at the tax sale public auction for over this amountyou might feasibly go and collect the distinction.

Tax Lien Foreclosures

This consists of showing you were the prior proprietor, completing some documentation, and waiting on the funds to be supplied. For the average individual that paid complete market value for their building, this method doesn't make much sense. If you have a severe quantity of cash invested right into a residential property, there's method also a lot on the line to simply "allow it go" on the off-chance that you can bleed some extra money out of it.

For instance, with the investing method I make use of, I might buy residential properties cost-free and clear for pennies on the dollar. To the shock of some investors, these bargains are Presuming you understand where to look, it's honestly not difficult to find them. When you can buy a residential property for a ridiculously inexpensive rate AND you know it's worth significantly more than you spent for it, it might effectively make sense for you to "roll the dice" and attempt to collect the excess earnings that the tax foreclosure and auction procedure generate.

While it can definitely work out comparable to the means I have actually explained it above, there are also a couple of drawbacks to the excess earnings approach you truly should be mindful of. While it depends significantly on the attributes of the residential or commercial property, it is (and in many cases, most likely) that there will certainly be no excess proceeds produced at the tax sale public auction.

Delinquent Tax Liens List

Or maybe the county does not create much public passion in their auctions. In any case, if you're purchasing a home with the of letting it go to tax obligation repossession so you can collect your excess earnings, what happens if that cash never comes via? Would certainly it deserve the time and money you will have squandered as soon as you reach this conclusion? If you're anticipating the county to "do all the job" for you, then think what, In a lot of cases, their schedule will essentially take years to pan out.

The first time I pursued this approach in my home state, I was informed that I really did not have the alternative of asserting the excess funds that were created from the sale of my propertybecause my state really did not permit it. In states like this, when they produce a tax sale overage at an auction, They just keep it! If you're assuming regarding utilizing this approach in your company, you'll wish to think long and hard concerning where you're working and whether their laws and statutes will even enable you to do it.

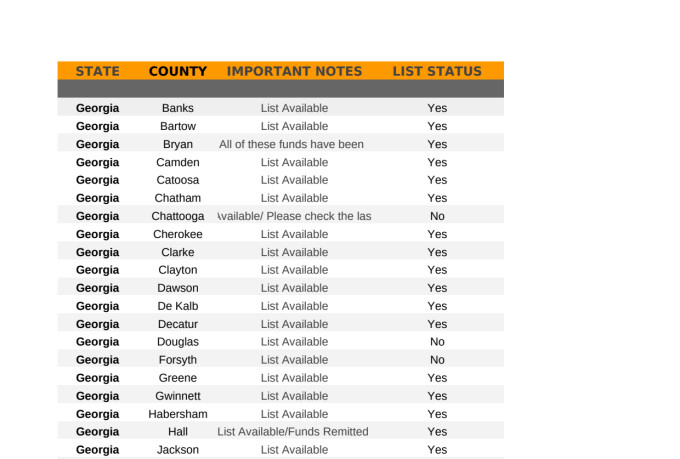

I did my ideal to give the appropriate solution for each state above, yet I would certainly advise that you prior to continuing with the presumption that I'm 100% proper (tax owed houses for sale). Keep in mind, I am not an attorney or a certified public accountant and I am not trying to offer out specialist lawful or tax obligation guidance. Speak to your attorney or certified public accountant prior to you act upon this information

The reality is, there are countless auctions around the nation each year. At most of these public auctions, hundreds (or perhaps thousands) of capitalists will certainly appear, enter into a bidding war over numerous of the residential or commercial properties, and drive rates WAY greater than they should be. This is partially why I have actually never been a massive fan of tax obligation sale auctions.

Latest Posts

Real Estate Tax Lien Investments For Tax Advantaged Returns

How To Invest In Tax Lien

What Is Tax Lien Investing