All Categories

Featured

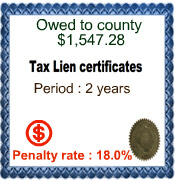

Investing in tax liens with acquisitions at a tax lien sale is just that-an investment. All Tax Sales in Colorado are carried out per CRS 39-11-101 thru 39-12-113 Adhering to the tax obligation lien sale, successful prospective buyers will certainly get a duplicate of the tax obligation lien certification of acquisition for each property. Spending in tax obligation liens with acquisition at the tax lien sale is just that, a financial investment.

Tax Lien And Tax Deed Investing

When a property owner drops behind in paying residential or commercial property tax obligations, the area or community may place tax lien versus the home. Rather of waiting for settlement of taxes, federal governments sometimes determine to offer tax obligation lien certifications to personal investors. Your income from a tax obligation lien financial investment will certainly come from one of two sources: Either passion payments and late fees paid by home owners, or repossession on the home sometimes for as little as pennies on the buck.

Latest Posts

Real Estate Tax Lien Investments For Tax Advantaged Returns

How To Invest In Tax Lien

What Is Tax Lien Investing